Today is the last day of this year’s Financial year.

If you haven’t paid “Property Tax” to your concerned department by today (31st March), you will get a penalty for the same when you pay.

We also ‘didn’t pay’

Property Tax of

1 building for 2 Years

For the last 2 years, we also ignored paying property tax for 1 building.

Yesterday Municipality (our property comes under Municipality) arranged a camp near our house for Tax collection.

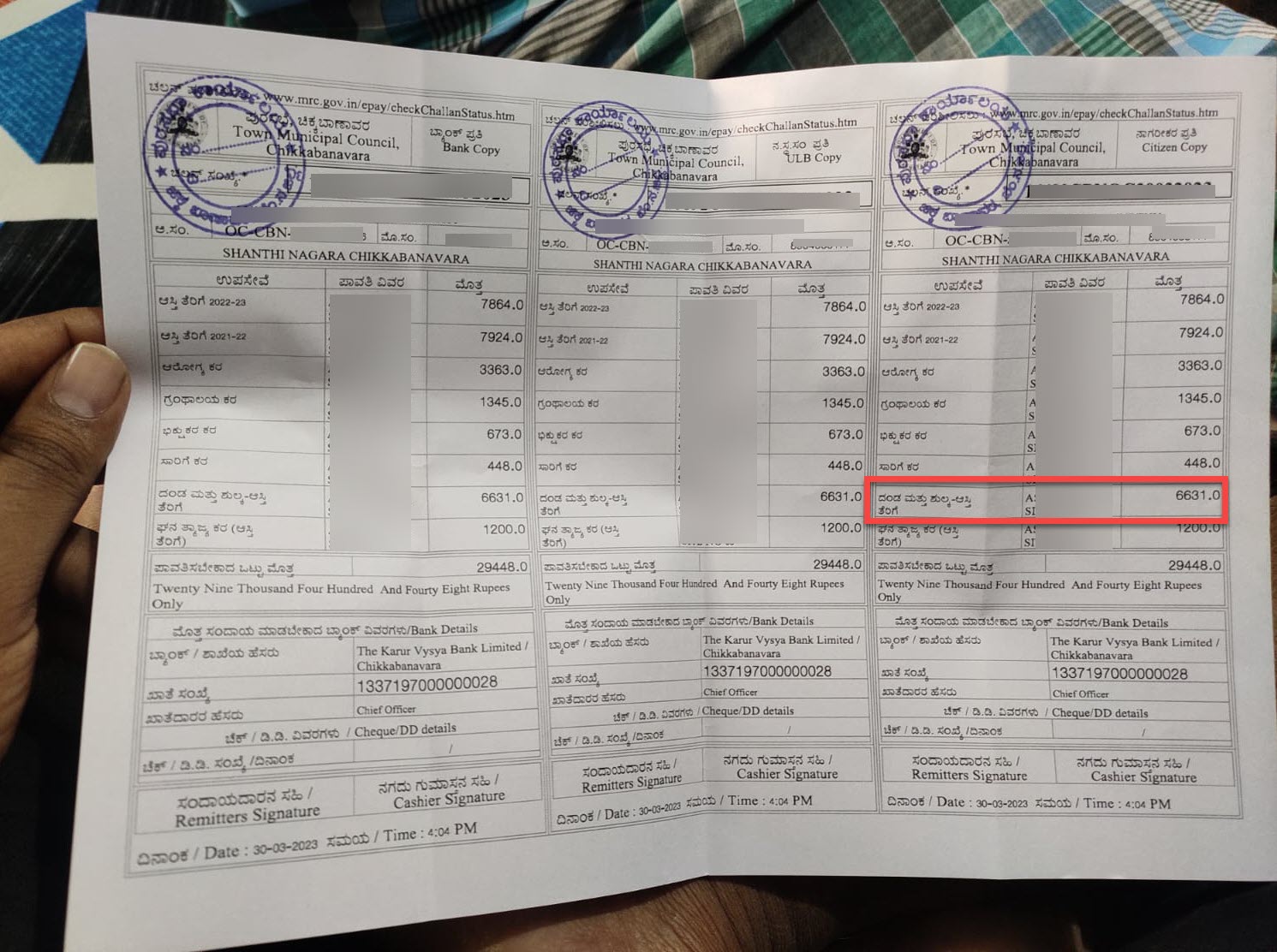

My dad and I went to pay the pending tax for the last 2 years of that building… Bill collector generated ₹29,448 as our property tax.

Which includes…

₹6,631 of Penality for just 2 Years!

Haven’t Paid Tax till?

So if you also ignore paying property tax, check once with your concerned department.

They could add a heavy penalty for not paying property tax on time every time.

And don’t think it applies only to Buildings…

Nope.

Property tax applies to Vacant land and Sheds as well. So don’t ignore and ends up paying heavy penalty like us.

Want to save?

Here is a tip I got from a bill collector to save some money.

If you pay tax every year in April, you will get 5% off of the original bill. It could differ from department to department, so check with your concerned department.

Anyway, I’m going to pay our property tax now.

Like us end up paying the penalty… You don’t pay extra money when buying cement from the nearest cement shops.

Learn how to buy cement to save money.

https://houseconstructionguide.com/cement-pricing-secrets/

Soon I’m planning to raise prices. Soo.. hurry if you are interested.